38+ can you put closing costs in mortgage

That means on a 300000 home loan you would pay from. Compare Loan Options and Compare Rates.

Can You Roll Closing Costs Into A Mortgage The Money Boy

Ad 10 Best Home Loan Lenders Compared Reviewed.

. Special Offers Just a Click Away. Web Closing costs arent universal. Ad Get an Affordable Mortgage Loan With Award-Winning Client Service.

Web Buyers may be able to roll closing costs into the home loan or they can also negotiate to have the seller shoulder some of the closing costs. For example on a 200000 mortgage buyers can expect to pay 6000. Lender fees Loan underwriting fees Mortgage discount points A.

Compare Loan Options and Compare Rates. Web Closing costs are expenses related to borrowing a mortgage and closing the home purchase Ailion says. Why do you have to pay closing costs.

Web Buyers can expect to pay about 3 6 of their loan amount on closing costs. Web These are not recurring fees but they can be expensive. Note that if you roll.

Web The percentage of your closing costs that your seller can cover depends on the type of loan that youre applying for. Ad Get an Affordable Mortgage Loan With Award-Winning Client Service. They include attorney fees title fees survey fees.

Each mortgage lender sets its own fees that are then passed on to borrowers when they finalize their home loans. Get Instantly Matched With Your Ideal Mortgage Lender. Web Options For Paying Loan Closing Costs.

Closing costs are the. Comparisons Trusted by 55000000. Web Your closing costs which will depend on your lender type of mortgage and home location may cost thousands of dollars theyre typically 2 to 5 of your home.

Average closing costs for the buyer run between about 2 and 6 of the loan amount. Web Closing costs are divided between you and the seller. In the US the closing cost on a mortgage can include an attorney fee the title service cost recording fee survey fee.

Ad Compare the Best Mortgage Lender To Finance You New Home. Web Assuming a 20 down payment you would need 80940 for a down payment plus several thousand more for closing costs and fees to your lender realtor. Choose Smart Apply Easily.

Web Closing costs typically range from 36 of the loan amount. Web Find out what closing costs you should expect to pay and learn how you could potentially reduce your expenses. 1 Thus if you buy a 200000 house your closing costs could range from 6000 to 12000.

Closing costs can quickly add up when you buy a house usually running between 3 and 4 of the purchase price. If the seller is reluctant to cover the closing. Web How much are closing costs.

As the buyer your portion of the costs may include. Lock Your Rate Today.

Join Our Team Carson Lowry Real Estate

Zero Point Mortgage Services Mortgage Brokers You Can Trust

Closing Costs Question

What Are The Pros And Cons Of Pace Loans Quora

Pacres Mortgage Tim Mcbratney Cma

Zero Point Mortgage Services Mortgage Brokers You Can Trust

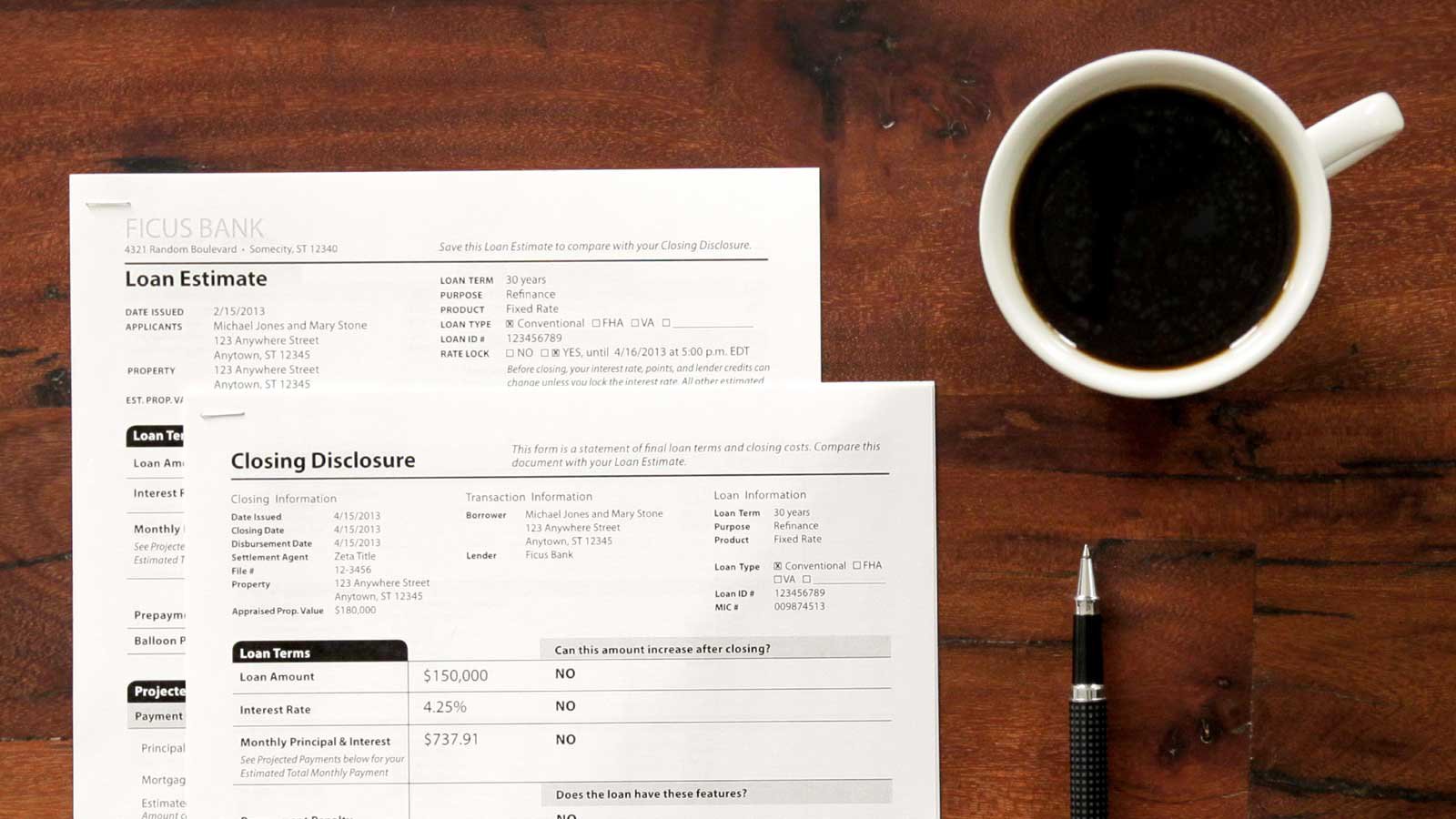

The Loan Estimate And Closing Disclosure What They Mean Nerdwallet

Can Closing Costs Rolled Into Your Loan Raise Your Interest Rate Youtube

What Are Mortgage Closing Costs Nerdwallet

Loan Estimate And Closing Disclosure Your Guides As You Choose The Home Loan That S Right For You Consumer Financial Protection Bureau

Can You Roll Closing Costs Into A Mortgage The Money Boy

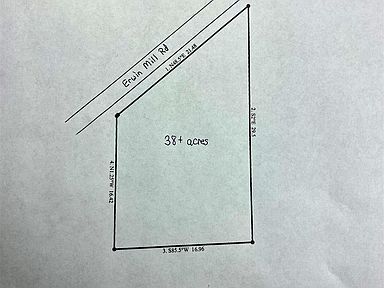

0 Erwin Mill Rd Honea Path Sc 29654 Mls 1441153 Zillow

5800 Closing Cost For Sfh 85k

Closing Costs What Are They And How Much Rocket Mortgage

Is It Smart To Roll Closing Costs Into Your Loan Carol Flanagan Guild Mortgage Llc

Estimating Your Home Buyer Closing Costs In Fort Hood Tx

What Are Mortgage Closing Costs Nerdwallet