Lifetime allowance

Web 1 day agoThe government will remove the Lifetime Allowance charge from 6 April 2023 before fully abolishing the Lifetime Allowance in a future Finance Bill. Over the average lifetime it refers to the projected value of your pensions excluding your state pension.

Pension Lifetime Allowance Lta Uk Pension Help

How to calculate the capital value of your pension benefits The lifetime allowance is based on the capital.

. The lifetime allowance LTA is a limit on what can be taken out of registered pension schemes without an LTA tax charge. Web Another myth surrounding the lifetime allowance is that it tends to only be a concern for people approaching retirement but thats not always the case. Web 1 day agoThe big surprise in Hunts speech was scrapping the lifetime allowance on pension pots from April which has limited the amount saved before tax charges apply.

Web In 2022-23 the lifetime allowance remained at 1073m and it is now frozen until 2026. Ad Your comprehensive guide to the UK Pension Lifetime Allowance is here. Web The lifetime allowance is the maximum amount of pension savings an individual can build up without a charge being applied when they take their benefits.

Web Lifetime allowance You usually pay tax if your pension pots are worth more than the lifetime allowance. You might be able to protect your pension pot from. Web The standard lifetime allowance is 1073100.

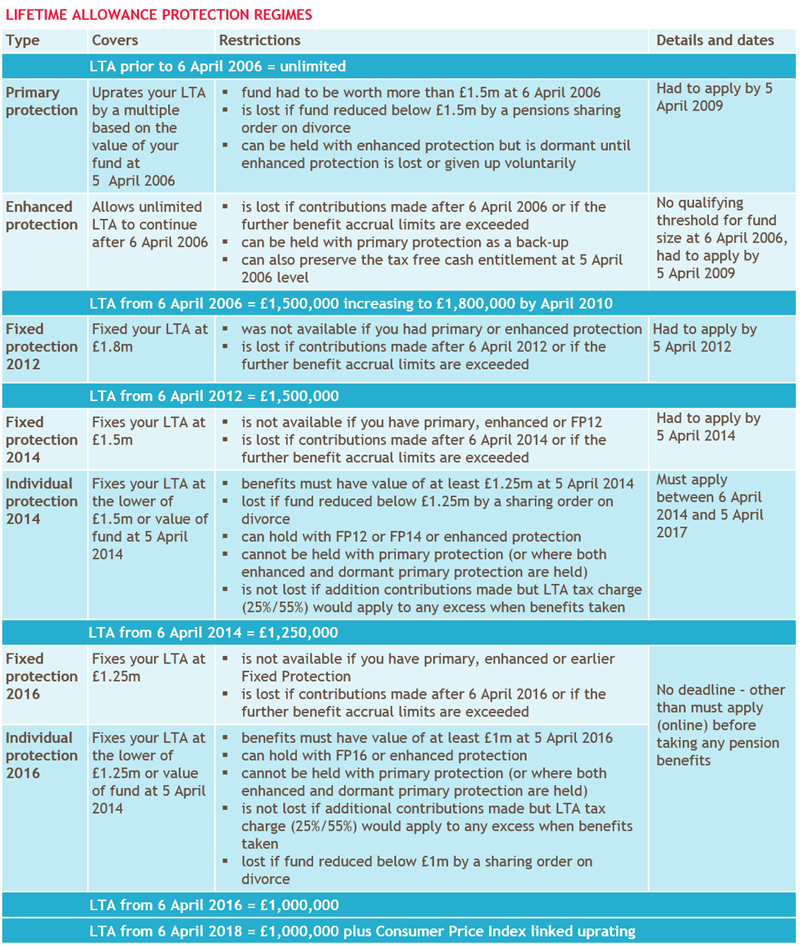

Web With Fixed Protection 2016 your lifetime allowance is fixed at 125 million. Tax relief on any pension benefits taken over this amount is recovered by the application of the lifetime allowance. Web The lifetime allowance charge applies to individuals who have benefits in excess of the lifetime allowance when benefits are taken.

Tax on the lump sum is. Web The current standard lifetime allowance is 1073100. Web The lifetime allowance is the total value of all pension benefits you can have without having to pay extra tax.

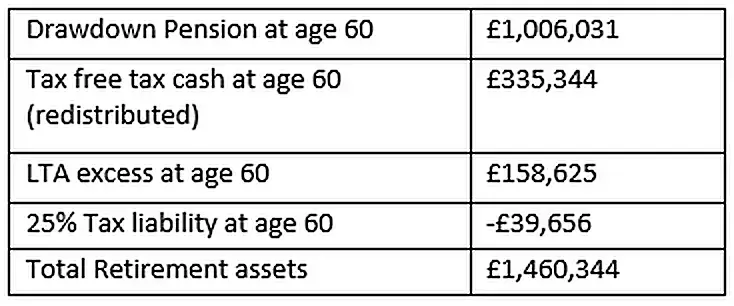

Web Example 2 Lifetime allowance tax charge Patrick opted to be paid the benefits in excess of the lifetime allowance as a lump sum. Web This measure applies to all members of registered pension schemes. Web The lifetime allowance for pensions LTA is set at 1073100 for the current tax year.

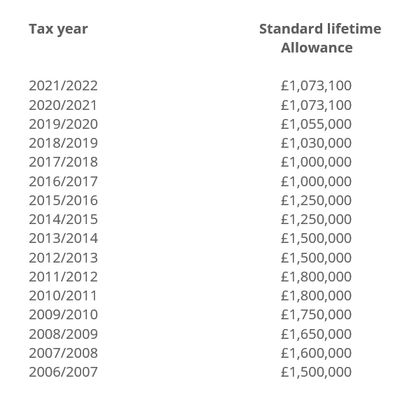

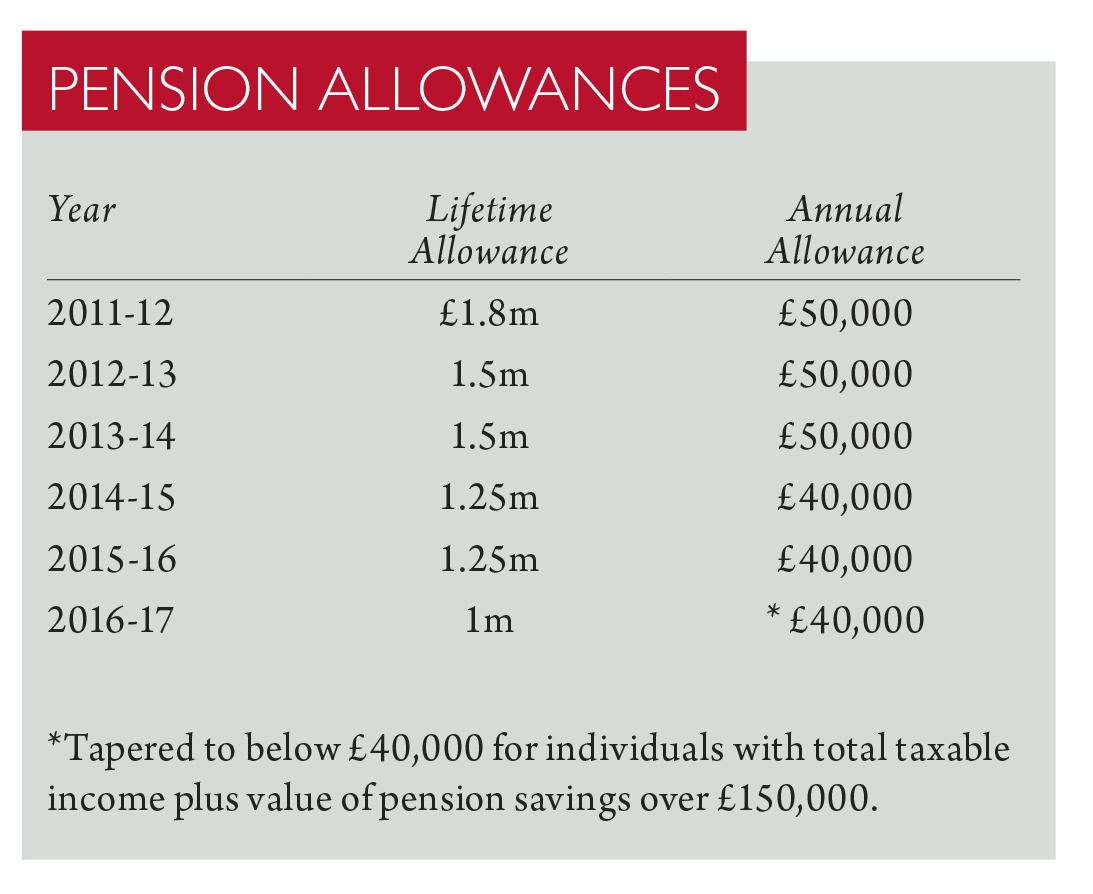

For 2020-21 the lifetime allowance or LTA for. Web Your pension lifetime allowance is 40000 per annum. The chart below shows the history of the lifetime allowances.

All pension benefits except the state. Web Pension Lifetime Allowance changed in April 2016 and action needs to be taken by people with pensions likely to be greater than 1000000 so that they can avoid having taxes. Web The lifetime allowance changes on April 6 each year in line with inflation set by the Consumer Price Index CPI.

Web The lifetime allowance. From 6 April 2023 it removes the Lifetime Allowance LTA charge and limits the pension. Web Lifetime allowance is the amount of pension savings an individual can make over a working lifetime without paying tax.

The lifetime allowance limit 202223 The 1073100 figure is set by. Web The lifetime allowance is the total amount you can build up in all your pension savings not including the state pension without incurring a tax charge. Web 19 rows Standard Lifetime Allowance - Royal London for advisers Technical Central Rates and factors Standard lifetime allowance Standard lifetime allowance The.

It means people will be allowed to put. Each time you take payment of a pension you use up a percentage of. Fixed Protection 2016 is lost if your benefits increase by more than the cost of living in any tax.

Web 1 day agoCurrently the lifetime allowance caps the total amount a person can save in a pension without having to pay an additional tax charge. Web 12 hours agoThis time its Jeremy Hunts abolition of the 107 million lifetime tax allowance on pensions from April to prevent doctors going into early retirement. This is currently 1073100.

Web 20 hours agoChancellor Jeremy Hunt used his budget on Wednesday to announce the abolition of the lifetime pensions allowance. Web Your lifetime allowance LTA is the maximum amount you can draw from pensions workplace or personal in your lifetime without paying extra tax. Under previous plans the.

Ad Your comprehensive guide to the UK Pension Lifetime Allowance is here.

9fvnnopwnsuggm

Mvjjlrplu1aatm

Pension Lifetime Allowance Explained Nerdwallet Uk

Understanding The Lifetime Allowance

1uuqbdv2buutum

What Is The Pension Lifetime Allowance Nuts About Money

Free Of Charge Creative Commons Lifetime Allowance Image Financial 11

Lifetime Allowance Finsgate

Will The Pension Lifetime Allowance Increase In The Uk What To Expect Bm

Everything You Need To Know About Your Pension Allowance Wealthify Com

Annual Tax Haul From Savers Breaching Lifetime Pension Limit Rises 153 This Is Money

Pensions And Tax The Lifetime Allowance Today S Wills And Probate

How To Pass The Cii R04 Demystifying The Annual Allowance And Lifetime Allowance

Z5kw8dvwrqdkm

Annual And Lifetime Pension Allowances Taxation

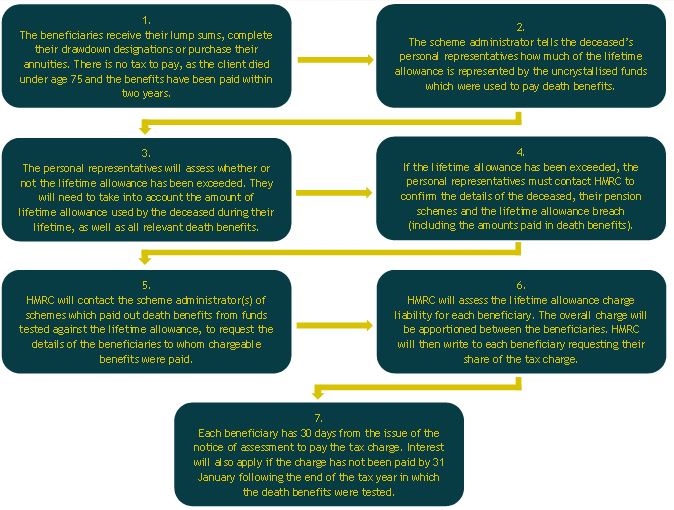

Paying A Lifetime Allowance Charge From Death Benefits Curtis Banks

Xjfvamqpnxrdhm